For the first half of 2023, we see the Middle East maintains its strong performance across the region. Meetings and events growth continues in the triple digits with 167% increase over the same period last year. Average meeting size is 200 attendees and 435 sqm as average space used. Corporate business is the main segment with 65.5% of meetings and events volume for this period.

Traditional industry segments on the decline?

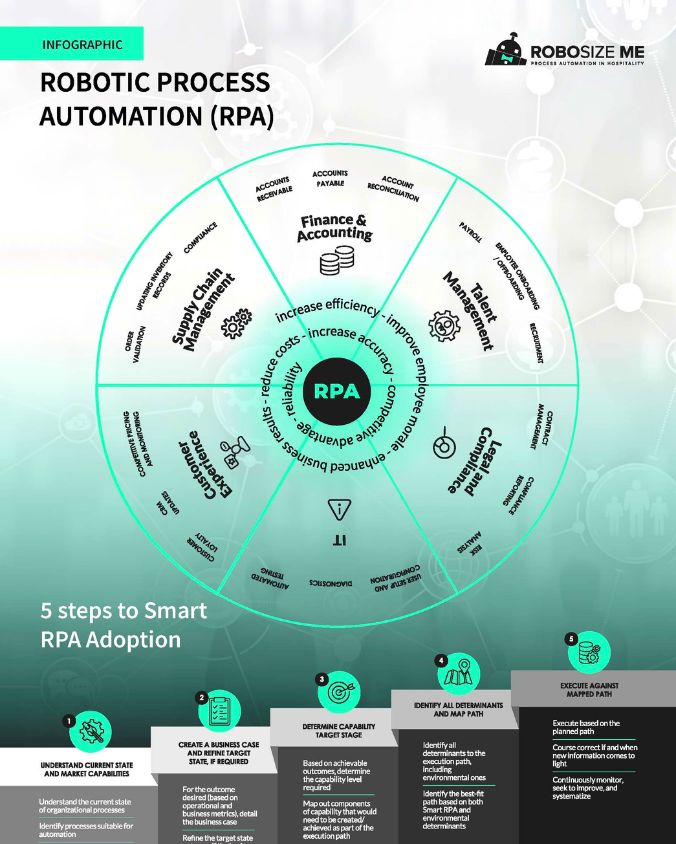

Despite the high performance of the region, there are a few industry segments not rebounding with the rest of the market. Looking at the top 10 industries in 2019 provides a view of this.

For the first half of 2019, event volume was driven primarily by three segments: Pharmaceuticals/Biotechnology, Financial/Banking and Technology. These industries represented 35 percent of corporate events and meetings in the region. For the same period in 2023, they account for only 20 percent.

This is a sizable shift from traditional industry segments and is unique to the region. Of the top 10 segments in 2019, these three industries show a significant decline in corporate meeting share.

At the same time, new “soft” industries are emerging and moving up in the rank. The top 2 industry segments for 2023 year-to-date are Travel and Training/Education. Currently, these two segments represent 22% of total event volume for the Middle East.

Another way to look at the industry shifts is to visualize the change in rank of the top ten industry segments. The biggest gain is by Travel, moving from #5 in 2019 to #1 in 2023, followed by Training/Education which moved from #4 to #2, and the Real Estate segment jumped from #12 to #10.

Although volumes are not as high as traditional segments, the most improved industries have the highest event volume growth over the period. These provide new opportunities for hoteliers in the Middle East and include: Urban Infrastructure (+352%), Tobacco (+345%), Fashion/Apparel (+193%), Marketing/Advertising (+170%), Communications (+148%) and Real Estate (+98%).

Find Opportunities in Emerging Markets

Doha, the upcoming destination of the region, presents unique growth opportunities for hoteliers

It is no surprise that Doha is experiencing strong competition due to increasing hotel supply. Meetings and events growth continues steady at 14% increase over the same period last year. Average meeting attendee size is lower than the Middle East overall at 124 attendees/event and as a result with lower estimated space used of 207 sqm . Like the rest of the region, the Corporate segment drives the majority of meetings with 51.6% of the volume for this period.

However, the makeup of the Corporate business in Doha varies significantly from the rest of the Middle East, presenting a range of unique opportunities for hoteliers who can develop specific offerings for these industries and their unique needs.

Knowland has recently opened the Doha market providing data insights to leading hotels and MICE venues in the region. For more information, click here.

Segments to watch: Real Estate, Oil/Gas/Energy and Financial/Banking

In terms of the top five Middle East industry segments that drive MICE production, Doha does not compete. It underperforms in five out of five of the top industries based on the percent of corporate events hosted. Other Middle East destinations, such as Dubai, are capturing the lion’s share of MICE business in these industries: Travel, Pharmaceutical/Biotechnology, Technology, Consulting and Marketing/Advertising.

Doha dominates the Middle East in 7 out of 8 of its high growth segments, featuring Real Estate, Oil/Gas/Energy and Financial/Banking. In these three industry groups, Doha outperforms the rest of the region in share of events by 2-4 times.

Doha has recently been successful in winning major global events, leveraging relationships, and attracting international meetings. On the heels of the 2022 FIFA World Cup, the Expo 2023 Doha is set to make history as the first A1 International Horticultural Exhibition in Qatar, the Middle East, and North Africa, developed under Qatar’s National Vision 2030.

The Formula 1-Qatar Grand Prix, The Geneva International Motor Show and the Institute of Travel and Tourism (ITT) conference are just some of the city-wide events lined up for 2023. Success with these global events translates into new Corporate MICE business and builds on Doha’s value as a world class meeting and event destination, which Knowland will be closely monitoring and supporting with regular trend analysis.

For information on Knowland data insights or solutions for the Middle East market, contact us at info@knowland.com or reach out to our representative, Erika Bucsi, Enterprise Director of Sales, EMEA & APAC at ebucsi@knowland.com.