May 10, 2023

Benchmarking hotels in your portfolio against each other, competitors, and the market helps you determine how well your properties are performing. What should benchmarking and KPIs look like in hotel asset management today? This blog explains how hotel benchmarking facilitates a better understanding of your portfolio.

What Is Hotel Benchmarking and Why Is It Important?

Hotel benchmarking helps you quantitatively evaluate a property’s performance against its competitors and the industry’s top players. With benchmarking, you can gain valuable insights like:

- How your hotel assets rank against their comp sets and markets

- How your current performance compares with the previous time periods

- Whether your portfolio’s metrics are improving and which KPIs to focus on

- What times of year present potential for development

You may think your hotel had a great month, but others might have done better! Hotel benchmarking provides an unbiased view of where your portfolio stands and how you can improve its performance going forward.

Comparing portfolio performance gives you an objective perspective on the latest industry trends. Key performance indications (KPIs) take the guesswork out of planning and answer critical questions about the market and your competitors.

The insights can help you fine-tune your sales, operational, and pricing strategies while identifying new opportunities to pursue. The ongoing improvements can help you optimize the ROI of your portfolio properties, gain market share, and improve sales productivity.

Important Hotel Benchmarking Metrics

Several KPIs are commonly used in hotel benchmarking to measure the success and efficiency of a hotel. These KPIs can vary depending on the type of hotel, its location, and its target market. When using Knowland, you can monitor these metrics by your individual property or an entire portfolio.

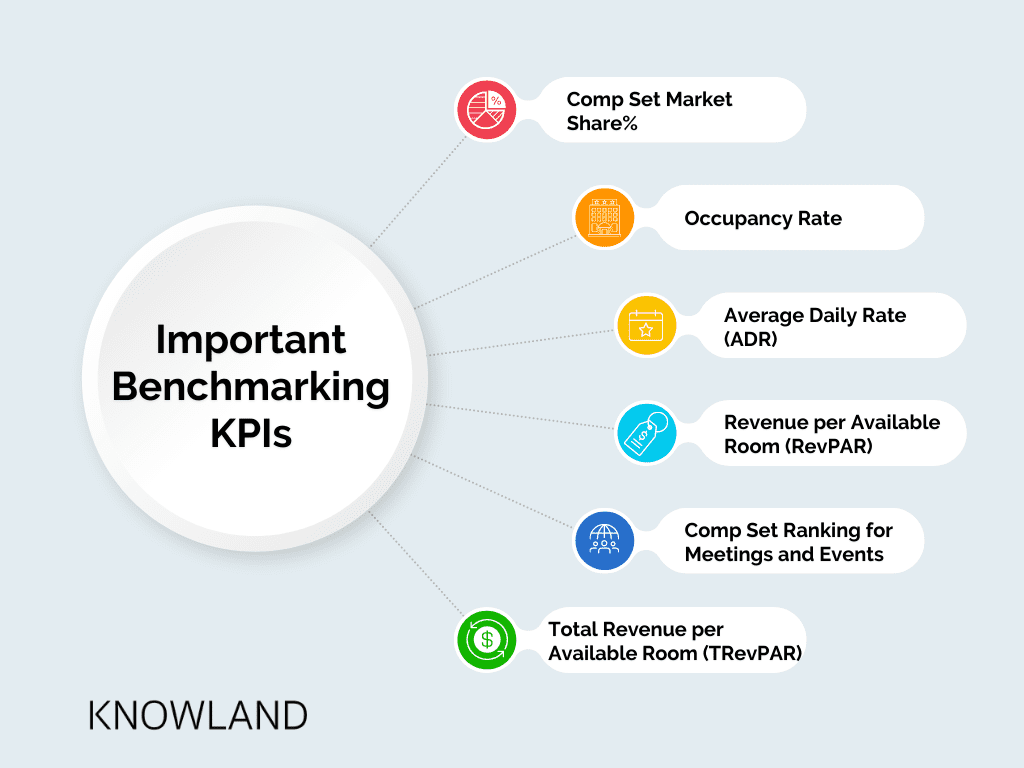

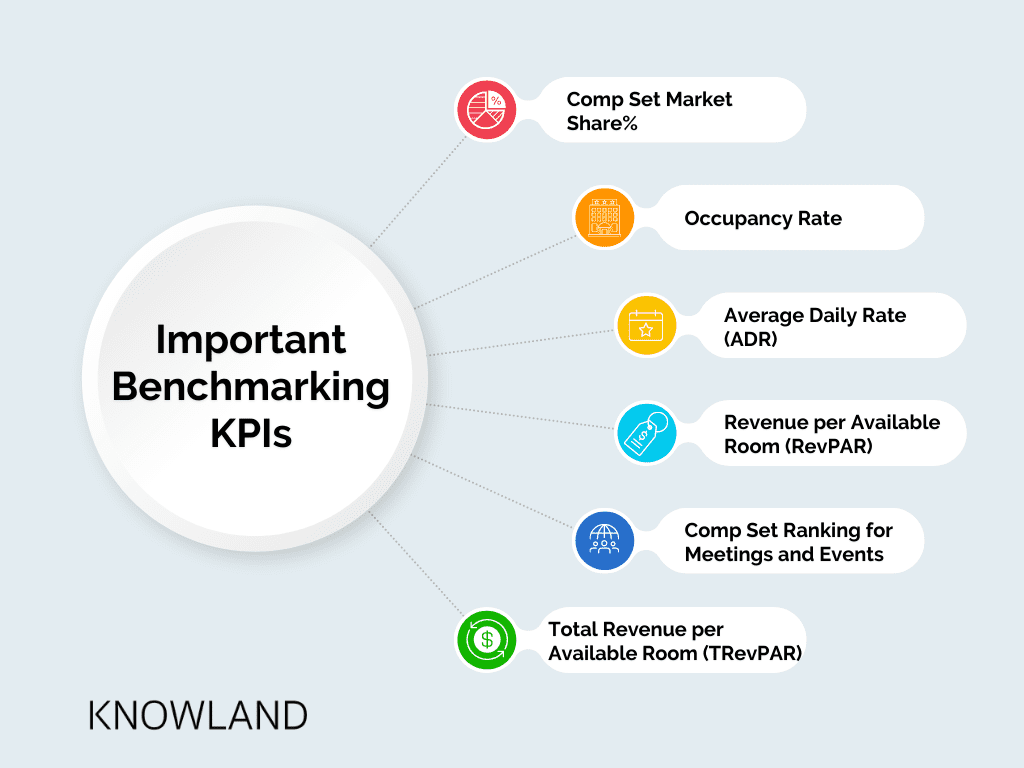

Some of the most important KPIs for hotel benchmarking include:

- Comp Set Market Share %: This looks at the percentage of total available business that a hotel is capturing compared to their comp set. It allows hoteliers to understand their position in the market and identify growth opportunities.

- Occupancy Rate: This measures the percentage of available rooms occupied during a specific period. It is a critical KPI for hotels as it indicates how well they attract and retain guests.

- Average Daily Rate (ADR): ADR measures the average price guests pay for a room in the hotel. It is calculated by dividing the total room revenue by the number of rooms sold.

- Revenue per Available Room (RevPAR): This measures the total revenue generated by the hotel per available room. It is calculated by multiplying the occupancy rate by the ADR.

- Comp Set Ranking for Meetings and Events: This rank shows a hotel’s position compared to its comp set for market share during a specific time period.

- Total Revenue per Available Room (TRevPAR):. This metric dives deeper into a property’s performance by calculating the total revenue earned per room. It includes all sources of income such as room rates, F&B sales, meeting space, and other ancillary revenue.

While these metrics are all essential for benchmarking, your goals determine which are most critical. For example, if the goal is to increase revenue, then RevPAR and ADR would be more important. If the goal is to capture more market share, then market share and total room nights would be more important.

See how you can use reliable data to assess the performance of each portfolio property.

6 Steps to Effective Group Performance Benchmarking

Here’s how to set a solid foundation for comparing hotel group business:

1. Understand the market

Know your market’s pace and identify trends impacting your group business to focus your benchmarking efforts on the right metrics.

2. Identify your competitors

Perform a competitive analysis to determine which hotels to measure your properties against. They should be comparable in room inventory, chain scale and class, property type, amenities, target audience, etc. Then, build out your comp sets and monitor them weekly.

3. Drill down into the data

Look beyond occupancy and ADR metrics to get a true read on your market. Be specific about the details of the metrics to identify market trends, customer demands, and top accounts.

4. Compare current data with past metrics

Leverage current and historical data sets to understand growth patterns, recognize trends, and identify new sales opportunities.

5. Design a roadmap

Embrace a learning mindset to analyze the insight from your benchmarking efforts. Create a roadmap to guide the growth strategy for your portfolio, such as where to allocate your sales resources.

6. Measure performance

Evaluate results regularly to verify you’re heading in the right direction. Also, identify the top and bottom performers to replicate the success and implement remediation programs.

Navigate Today’s Benchmarking Challenges with Knowland

The hospitality industry has made its comeback. However, the markets have changed significantly post-pandemic. You can’t simply compare 2019's data with current metrics to assess performance accurately.

Additionally, hotel asset managers must tackle the minutia of collating data from various systems used by different properties. The information often comes in incompatible formats, requiring hours of logging onto multiple systems, copy-and-pasting, and normalizing the data.

Still, data across properties, their comp sets, and markets allow hotel management to act on impactful market trends.

The good news is you don’t have to reinvent the wheel.

Knowland's benchmarking tool, Portfolio Capture, is designed to help hotel owners manage a portfolio of assets efficiently and effectively. Portfolio Capture shows you how each hotel’s comp set performs and where the growth opportunities lie. You can see standardized KPIs on every asset to measure performance and use the insights to improve your hotel operation.