Discover the most important hospitality trends in 2023 and how they’re shaping guest experiences and hotel operations.

As we approach the last quarter of 2023, we look at the most important trends that have been shaping the hospitality industry.

We also offer tips on how hotels can elevate their guest experiences and business operations by capitalizing on financial technology.

1. Guests want experiences, not products

What?

It’s nearly the end of 2023 and hotel room rates continue to increase due to inflation, dragging down guest satisfaction.

So expectations have changed. Today’s guests and tourists expect both hyper-personalization and unique experiences. They want to feel special in return for the money they spend.

Guests want hotels to remember their individual needs and preferences and deliver experiences that are specifically tailored to them. This ranges from welcome baskets and in-room services to promotions and room upgrades.

At the same time, more guests and tourists are seeking unique experiences and activities and not just a comfortable place to spend the night in. From yoga retreats and surf camps to diving trips, food tours, and dark tourism, many guests are searching for memorable and immersive adventures. They’re after those “Instagrammable” moments.

So what?

This is a ripe opportunity for hospitality businesses to venture beyond the conventional services they’ve traditionally offered.

In fact, 65% of hospitality businesses predict they’ll become “experience centers” where guests can engage more closely with their brand. Another 62% saw better conversion rates from personalization. After all, guests are willing to shell out a little extra for more personalized experiences.

Now what?

As the industry embraces the experience economy trend, businesses are coming face to face with the demanding task of personalization. Resonating with guests is no easy feat. Knowing which guests want what and when is a business in and of itself.

Payments data can clear the way for delivering better personalized experiences and catering to guest expectations from pre-arrival to post-stay. Hotels can use real-time payments data to get insights into where guests come from, how they want to pay, how much they spend, what they spend their money on, and why they’re visiting (e.g., for work, leisure, or a mixture).

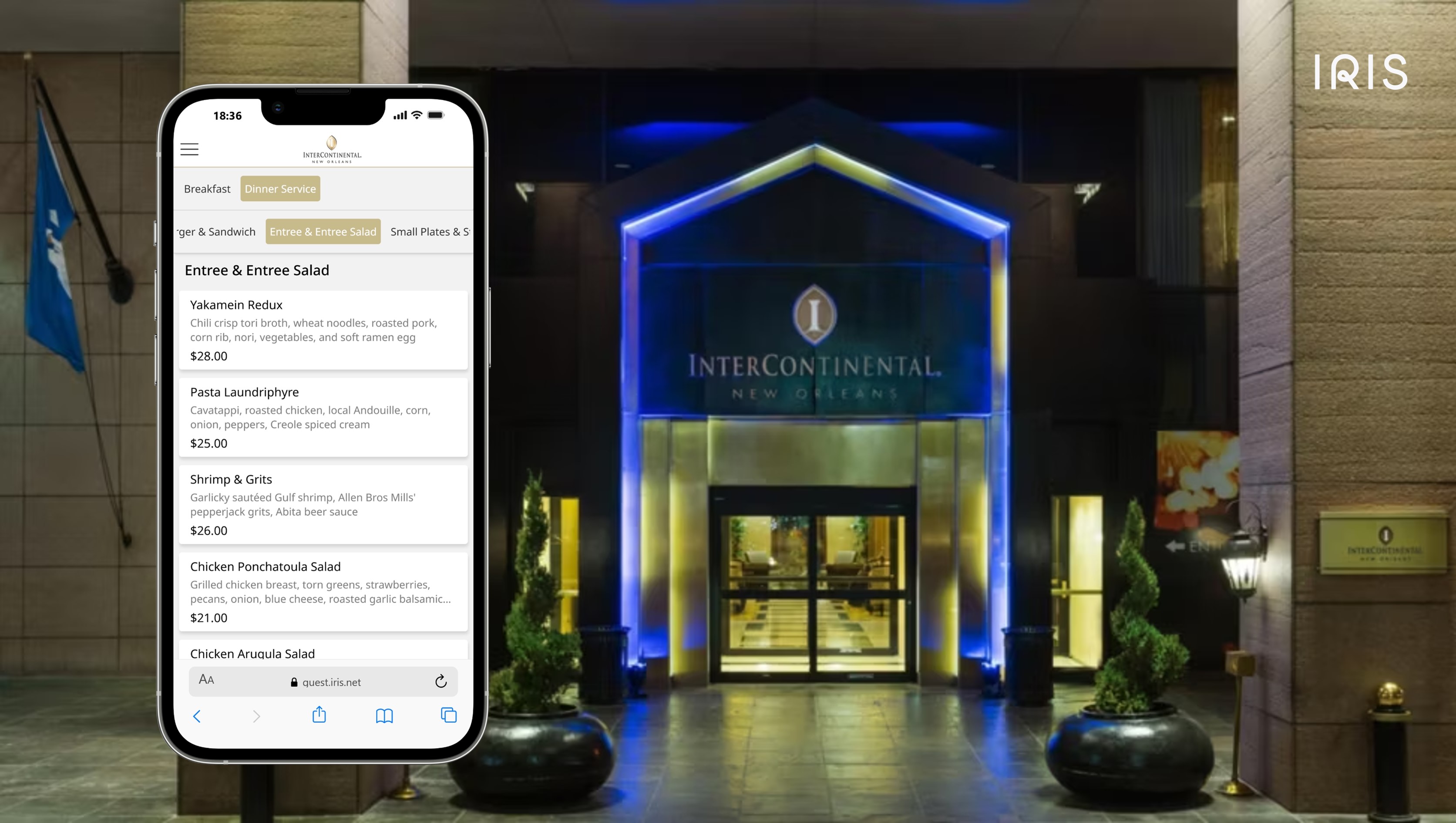

Hotels can then personalize their upsells and cross-sells, from room upgrades and transportation to food and beverage amenities.

They can also offer a variety of check-in and check-out options for different guest segments. Business travelers, for example, prefer to bypass the front desk and get to their rooms faster so they can rest or work. So self check-in kiosks or mobile check-ins might work better for them.

Hotels can also become curators for the experiences their guests seek. For instance, they can partner with local businesses to recommend local excursions, offer organic toiletries made from local ingredients, hold cooking classes on the local cuisine, and share insider tips on lesser-known attractions. This extends to luxury hotels, which can offer unique and personalized culinary experiences like farm-to-table dining concepts or design holistic wellness programs so guests can rejuvenate.

2. Omnichannel payments technology upgrades experiences for guests and hotels alike

What?

Long gone are the days when guests could only reserve rooms by calling hotels or using travel agents, and when they could only pay for their stay in-person. In 2000, offering online bookings was still considered revolutionary. Now it’s business as usual.

Today, the majority of hotel reservations take place online, whether through online travel agencies or a hotel’s own website or app.

And guests pay for these reservations on different channels, both online and in-person. In 2022, 72% of guests paid for their trips online and a sizable portion (almost 1 in 3) paid in-person.

So what?

We’re operating in the era of consumer flexibility and choice. If guests don’t get what they want, they’ll switch to another hotel or reservation channel. In fact, 55% of guests don’t complete their reservations if they can’t pay how they want.

As inflation continues to test guest loyalty, the hospitality industry is pressed into giving more options. In 2022, 39% of hospitality businesses offered both online and in-person payment methods to cater to their guests’ diverse preferences.

Now what?

It’s not enough to offer more payment methods or channels. How it’s done matters. With payments, it’s about quality, not just quantity.

A significant problem with most payment setups in the hospitality industry is that there are separate backend systems and payment providers for each payment channel. So while guests can engage with the hotel on premise or through mobile apps, the payment journeys remain separate and feed into disconnected systems.

Disconnected systems and fragmentation mean more operational hassle, costs, and lost insights for the business. Guests can also experience the brand inconsistently, sometimes to the extent of experiencing separate brands and not one.

Omnichannel solutions, like Unified Commerce, unify all systems, whether customer-facing or backend. Whenever a hotel adds a new channel, it gets connected to the other payment systems on a single platform that has all data from across the hotel’s different departments and properties.

This makes it easier for the staff to stay on top of their tasks and answer guest needs faster and with a more personalized element.

3. Fraud is on the rise but new security solutions have strong potential

What?

Hospitality is one of the industries most prone to cyberattacks. In 2022, over a third of hospitality businesses worldwide (37%) experienced increased payment fraud attempts. Another 32% experienced data leaks.

At the same time, compliance with security regulations like the Payment Card Industry (PCI) Data Security Standard and the revised Payment Services Directive (PSD2) remains difficult and time consuming. Many hotels face challenges when setting up and implementing security measures that meet these constantly changing requirements. These range from outdated systems to a shortage of staff and technological resources.

So what?

Rising fraud brings significant costs, loss of sensitive data, and reputational damage to hotels. The average cost of a breach in the industry is estimated at $3.4 million.

Non-compliance also results in hefty fines. For example, fines for not meeting the PCI requirements may range anywhere from $5000 to $100,000 per month, and this is only for the first three months of non-compliance.

There are other penalties as well. For example, hotels that aren’t PCI compliant could lose their ability to process credit card payments. Hotels can’t afford this because card payments rank at the top in the industry, accounting for 44% of worldwide transactions in 2022.

Now what?

Hotels can work with the right fintech partner to implement a compliant security system that addresses all stages in the payments data lifecycle, from collection and transfer to processing, storage, and disposal.

New cybersecurity solutions are frequently launched and hotels can choose what suits their business needs. Notable among these is tokenization.

Tokenization converts a guest’s payment data into a string of randomized numbers, or tokens, so that it can be safely stored and shared between hotels and their different partners. It’s a PCI-compliant solution that also brings about a host of benefits, like operational agility, automation, and insights-driven personalization. And it lets guests move without their wallets and still pay for drinks, meals, and spa treatments at hotels. In a nutshell, more security with style.

4. Automation helps hotels find operational agility

What?

Many hotels still rely on manual processes in their daily operations.

Staff may manually register a guest into the system at the reception or type the payment details which a guest shares over the phone to complete reservations.

Payment reconciliation is also largely manual, with only 22% of hospitality businesses having centralized reconciliation across all sales channels. This means that the finance team manually checks each of the hotel’s sales transactions, through all payment channels and methods. And they must spot inconsistencies between the hotel’s own sales data and the data from the payment service providers.

So what?

Manual tasks in hotels are resource intensive, time consuming, and inefficient. Staff may lose track of completed and pending tasks, like which hotel rooms to clean next. Updating room availability across the numerous distribution channels and travel agencies also takes up significant time if done manually and it’s prone to errors like double bookings.

On top of this, hotels have been experiencing a staffing shortage. Many young workers leave for the gig economybecause it offers flexible work arrangements and doesn’t require learning multiple outdated systems. This leaves hotels with far too few staff to handle the many mundane tasks involved in running a hotel.

Now what?

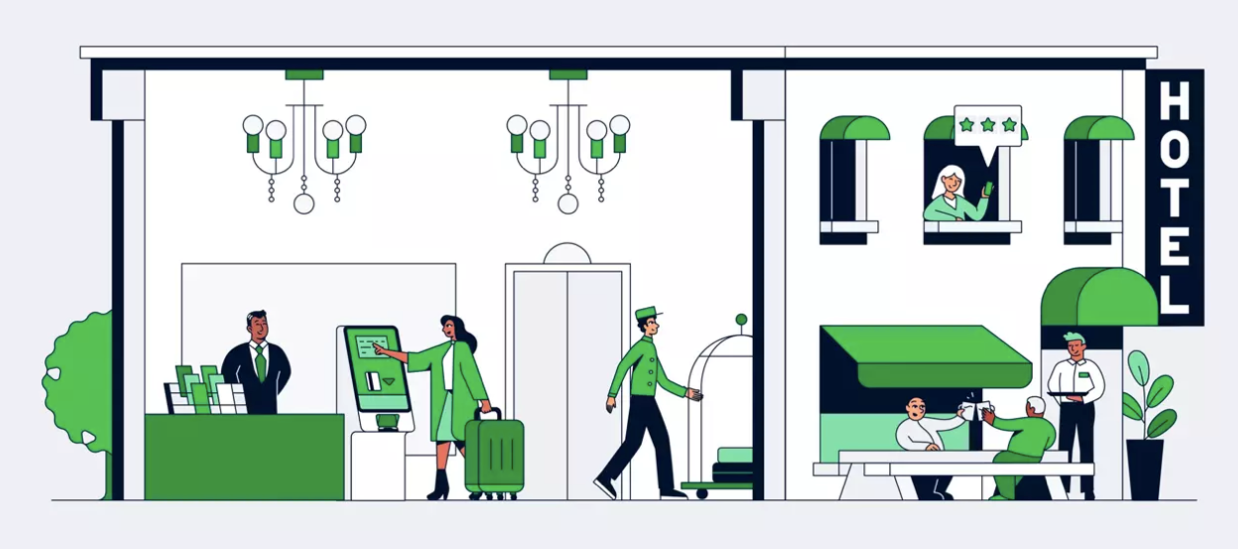

Automation helps meet this challenge. It doesn’t replace staff or substitute human interaction. Instead, it optimizes workflows.

Solutions like contactless payments, mobile check-ins, real-time payments data, and tokenization aren’t just nice-to-haves. They allow hotels to accurately and swiftly capture guest data and payment details.

The hotel’s front desk staff doesn’t waste time manually entering card details onto payment terminals. They can instead focus on engaging with guests and answering their requests faster. They can also identify repeat guests and personalize their stays.

And a smooth integration with key partners (like booking engines and property management systems) provides insights into the exact booking status of rooms for a more straightforward reservation process.

Hotels can then apply better pricing strategies, adjusting the rates depending on the market demand, room types, and guest segments. They can also reduce the workload of finance teams by up to 10 hours by automating reconciliation and removing the need to conduct night audits.

A payments strategy fit for hotels and guests

Payments in hospitality aren’t just about revenues, costs, and transactions. They’re part of the overall business operations and customer experience. So having the right payments setup matters.

That’s why we delved into the world of financial technology and payments in our 2023 Hospitality Guide to share actionable insights into how hospitality businesses can upgrade their payments.

And we added a giveaway: A checklist that businesses can use to evaluate their current payments framework and identify any gaps in it.

Download the 2023 Hospitality Guide